Debt is driving this system of auto-cannibalism which, by every measure of social wellbeing, is relentlessly turning a developed country into an underdeveloped one.

By Steve Fraser PhilosophersforChange.org February 12, 2013

Shakespeare’s Polonius offered this classic advice to his son: “neither a borrower nor a lender be.” Many of our nation’s Founding Fathers emphatically saw it otherwise. They often lived by the maxim: always a borrower, never a lender be. As tobacco and rice planters, slave traders, and merchants, as well as land and currency speculators, they depended upon long lines of credit to finance their livelihoods and splendid ways of life. So, too, in those days, did shopkeepers, tradesmen, artisans, and farmers, as well as casual laborers and sailors. Without debt, the seedlings of a commercial economy could never have grown to maturity.

Subscribe or “Follow” us on RiseUpTimes.org. Rise Up Times is also on Facebook! Check the Rise Up Times page for posts from this blog and more! “Like” our page today. Rise Up Times is also on Pinterest, Google+ and Tumblr. Find us on Twitter at Rise Up Times (@touchpeace).

Ben Franklin, however, was wary on the subject. “Rather go to bed supperless than rise in debt” was his warning, and even now his cautionary words carry great moral weight. We worry about debt, yet we can’t live without it.

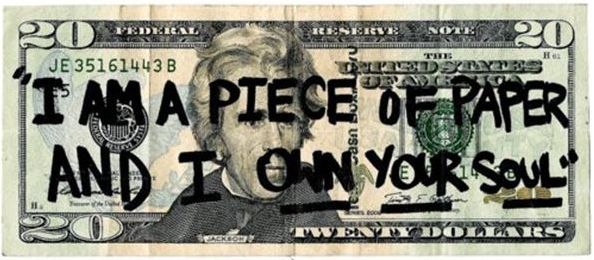

Debt remains, as it long has been, the Dr. Jekyll and Mr. Hyde of capitalism. For a small minority, it’s a blessing; for others a curse. For some the moral burden of carrying debt is a heavy one, and no one lets them forget it. For privileged others, debt bears no moral baggage at all, presents itself as an opportunity to prosper, and if things go wrong can be dumped without a qualm.

Those who view debt with a smiley face as the royal road to wealth accumulation and tend to be forgiven if their default is large enough almost invariably come from the top rungs of the economic hierarchy. Then there are the rest of us, who get scolded for our impecunious ways, foreclosed upon and dispossessed, leaving behind scars that never fade away and wounds that disable our futures.

Think of this upstairs-downstairs class calculus as the politics of debt. British economist John Maynard Keynes put it like this: “If I owe you a pound, I have a problem; but if I owe you a million, the problem is yours.”

After months of an impending “debtpocalypse,” the dreaded “debt ceiling,” and the “fiscal cliff,” Americans remain preoccupied with debt, public and private. Austerity is what we’re promised for our sins. Millions are drowning, or have already drowned, in a sea of debt — mortgages gone bad, student loans that may never be paid off, spiraling credit card bills, car loans, payday loans, and a menagerie of new-fangled financial mechanisms cooked up by the country’s “financial engineers” to milk what’s left of the American standard of living.

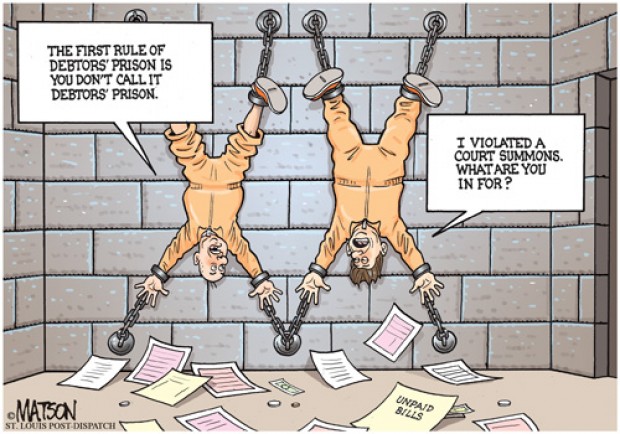

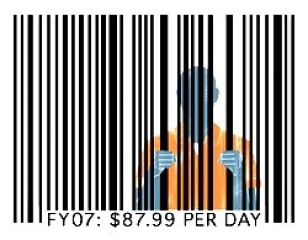

The world economy almost came apart in 2007-2008, and still may do so under the whale-sized carcass of debt left behind by financial plunderers who found in debt the leverage to get ever richer. Most of them still live in their mansions and McMansions, while other debtors live outdoors, or in cars or shelters, or doubled-up with relatives and friends — or even in debtor’s prison. Believe it or not, a version of debtor’s prison, that relic of early American commercial barbarism, is back.

In 2013, you can’t actually be jailed for not paying your bills, but ingenious corporations, collection agencies, cops, courts, and lawyers have devised ways to insure that debt “delinquents” will end up in jail anyway. With one-third of the states now allowing the jailing of debtors (without necessarily calling it that), it looks ever more like a trend in the making.

Will Americans tolerate this, or might there emerge a politics of resistance to debt, as has happened more than once in a past that shouldn’t be forgotten?

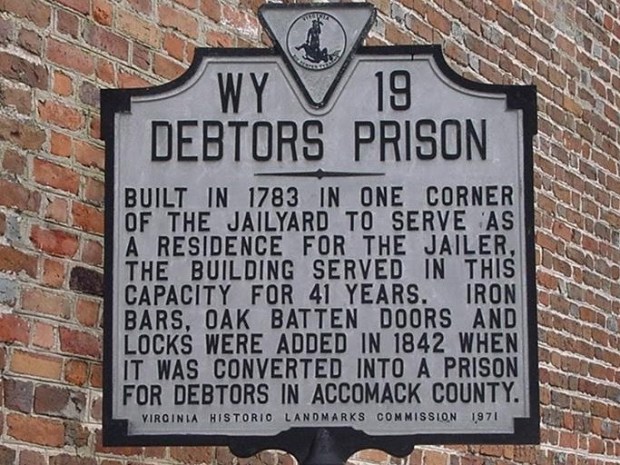

The World of Debtor’s Prisons

Imprisonment for debt was a commonplace in colonial America and the early republic, and wasn’t abolished in most states until the 1830s or 1840s, in some cases not until after the Civil War. Today, we think of it as a peculiar and heartless way of punishing the poor — and it was. But it was more than that.

Some of the richest, most esteemed members of society also ended up there, men like Robert Morris, who helped finance the American Revolution and ran the Treasury under the Articles of Confederation; John Pintard, a stock-broker, state legislator, and founder of the New York Historical Society; William Duer, graduate of Eton, powerful merchant and speculator, assistant secretary in the Treasury Department of the new federal government, and master of a Hudson River manse; a Pennsylvania Supreme Court judge; army generals; and other notables.

Whether rich or poor, you were there for a long stretch, even for life, unless you could figure out some way of discharging your debts. That, however, is where the similarity between wealthy and impoverished debtors ended.

Whether in the famous Marshalsea in London where Charles Dickens had Little Dorritt’s father incarcerated (and where Dickens’s father had actually languished when the author was 12), or in the New Gaol in New York City, where men like Duer and Morris did their time, debtors prisons were segregated by class. If your debts were large enough and your social connections weighty enough (the two tended to go together) you lived comfortably. You were supplied with good food and well-appointed living quarters, as well as books and other pleasures, including on occasion manicurists and prostitutes.

Robert Morris entertained George Washington for dinner in his “cell.” Once released, he resumed his career as the new nation’s richest man. Before John Pintard moved to New Gaol, he redecorated his cell, had it repainted and upholstered, and shipped in two mahogany writing desks.

Meanwhile, the mass of petty debtors housed in the same institution survived, if at all, amid squalor, filth, and disease. They were often shackled, and lacked heat, clean water, adequate food, or often food of any kind. (You usually had to have the money to buy your own food, clothing, and fuel.) Debtors in these prisons frequently found themselves quite literally dying of debt. And you could end up in such circumstances for trivial sums. Of the 1,162 jailed debtors in New York City in 1787, 716 owed less than twenty shillings or one pound. A third of Philadelphia’s inmates in 1817 were there for owing less than $5, and debtors in the city’s prisons outnumbered violent criminals by 5:1. In Boston, 15% of them were women. Shaming was more the point of punishment than anything else.

Scenes of public pathos were commonplace. Inmates at the New Gaol, if housed on its upper floors, would lower shoes out the window on strings to collect alms for their release. Other prisons installed “beggar gates” through which those jailed in cellar dungeons could stretch out their palms for the odd coins from passersby.

Poor and rich alike wanted out. Pamphleteering against the institution of debtor’s prison began in the 1750s. An Anglican minister in South Carolina denounced the jails, noting that “a person would be in a better situation in the French King’s Gallies, or the Prisons of Turkey or Barbary than in this dismal place.” Discontent grew. A mass escape from New Gaol of 40 prisoners armed with pistols and clubs was prompted by extreme hunger.

In the 1820s and 1830s, as artisans, journeymen, sailors, longshoremen, and other workers organized the early trade union movement as well as workingmen’s political parties, one principal demand was for the abolition of imprisonment for debt. Inheritors of a radical political culture, their complaints echoed that Biblical tradition of Jubilee mentioned in Leviticus, which called for a cancellation of debts, the restoration of lost houses and land, and the freeing of slaves and bond servants every 50 years.

Falling into debt was a particularly ruinous affliction for those who aspired to modest independence as shopkeepers, handicraftsmen, or farmers. As markets for their goods expanded but became ever less predictable, they found themselves taking out credit to survive and sometimes going into arrears, often followed by a stint in debtor’s prison that ended their dreams forever.

However much the poor organized and protested, it was the rich who got debt relief first. Today, we assume that debts can be discharged through bankruptcy (although even now that option is either severely restricted or denied to certain classes of less favored debt delinquents like college students). Although the newly adopted U.S. Constitution opened the door to a national bankruptcy law, Congress didn’t walk through it until 1800, even though many, including the well-off, had been lobbying for it.

Enough of the old moral faith that frowned on debt as sinful lingered. The United States has always been an uncharitable place when it comes to debt, a curious attitude for a society largely settled by absconding debtors and indentured servants (a form of time-bound debt peonage). Indeed, the state of Georgia was founded as a debtor’s haven at a time when England’s jails were overflowing with debtors.

When Congress finally passed the Bankruptcy Act, those in the privileged quarters at New Gaol threw a party. Down below, however, life continued in its squalid way, since the new law only applied to people who had sizable debts. If you owed too little, you stayed in jail.

Debt and the Birth of a Nation

Nowadays, the conservative media inundate us with warnings about debt from the Founding Fathers, and it’s true that some of them like Jefferson — himself an inveterate, often near-bankrupt debtor — did moralize on the subject. However, Alexander Hamilton, an idol of the conservative movement, was the architect of the country’s first national debt, insisting that “if it is not excessive, [it] will be to us a national blessing.”

As the first Secretary of the Treasury, Hamilton’s goal was to transform the former 13 colonies, which today we would call an underdeveloped land, into a country that someday would rival Great Britain. This, he knew, required liquid capital (resources not tied up in land or other less mobile forms of wealth), which could then be invested in sometimes highly speculative and risky enterprises. Floating a national debt, he felt sure, would attract capital from well-positioned merchants at home and abroad, especially in England.

However, for most ordinary people living under the new government, debt aroused anger. To begin with, there were all those veterans of the Revolutionary War and all the farmers who had supplied the revolutionary army with food and been paid in notoriously worthless “continentals” — the currency issued by the Continental Congress — or equally valueless state currencies.

As rumors of the formation of a new national government spread, speculators roamed the countryside buying up this paper money at a penny on the dollar, on the assumption that the debts they represented would be redeemed at face value. In fact, that is just what Hamilton’s national debt would do, making these “sunshine patriots” quite rich, while leaving the yeomanry impoverished.

Outrage echoed across the country even before Hamilton’s plan got adopted. Jefferson denounced the currency speculators as loathsome creatures and had this to say about debt in general: “The modern theory of the perpetuation of debt has drenched the earth with blood and crushed its inhabitants under burdens ever accumulating.” He and others denounced the speculators as squadrons of counter-revolutionary “moneycrats” who would use their power and wealth to undo the democratic accomplishments of the revolution.

In contrast, Hamilton saw them as a disinterested monied elite upon whom the country’s economic well-being depended, while dismissing the criticisms of the Jeffersonians as the ravings of Jacobin levelers. Soon enough, political warfare over the debt turned founding fathers into fratricidal brothers.

Hamilton’s plan worked — sometimes too well. Wealthy speculators in land like Robert Morris, or in the building of docks, wharves, and other projects tied to trade, or in the national debt itself — something William Duer and grandees like him specialized in — seized the moment. Often enough, however, they over-reached and found themselves, like the yeomen farmers and soldiers, in default to their creditors.

Duer’s attempts to corner the market in the bonds issued by the new federal government and in the stock of the country’s first National Bank represented one of the earliest instances of insider trading. They also proved a lurid example of how speculation could go disastrously wrong. When the scheme collapsed, it caused the country’s first Wall Street panic and a local depression that spread through New England,ruining “shopkeepers, widows, orphans, butchers…gardeners, market women, and even the noted Bawd Mrs. McCarty.”

A mob chased Duer through the streets of New York and might have hanged or disemboweled him had he not been rescued by the city sheriff, who sent him to the safety of debtor’s prison. John Pintard, part of the same scheme, fled to Newark, New Jersey, before being caught and jailed as well.

Sending the Duers and Pintards of the new republic off to debtors’ prison was not, however, quite what Hamilton had in mind. And leaving them rotting there was hardly going to foster the “enterprising spirit” that would, in the treasury secretary’s estimation, turn the country into the Great Britain of the next century. Bankruptcy, on the other hand, ensured that the overextended could start again and keep the machinery of commercial transactions lubricated. Hence, the Bankruptcy Act of 1800.

If, however, you were not a major player, debt functioned differently. Shouldered by the hoi polloi, it functioned as a mechanism for funneling wealth into the mercantile-financial hothouses where American capitalism was being incubated.

No wonder debt excited such violent political emotions. Even before the Constitution was adopted, farmers in western Massachusetts, indebted to Boston bankers and merchants and in danger of losing their ancestral homes in the economic hard times of the 1780s, rose in armed rebellion. In those years, the number of lawsuits for unpaid debt doubled and tripled, farms were seized, and their owners sent off to jail. Incensed, farmers led by a former revolutionary soldier, Daniel Shays, closed local courts by force and liberated debtors from prisons. Similar but smaller uprisings erupted in Maine, Connecticut, New York, and Pennsylvania, while in New Hampshire and Vermont irate farmers surrounded government offices.

Shays’ Rebellion of 1786 alarmed the country’s elites. They depicted the unruly yeomen as “brutes” and their houses as “sties.” They were frightened as well by state governments like Rhode Island’s that were more open to popular influence, declared debt moratoria, and issued paper currencies to help farmers and others pay off their debts. These developments signaled the need for a stronger central government fully capable of suppressing future debtor insurgencies.

Federal authority established at the Constitutional Convention allowed for that, but the unrest continued. Shays’ Rebellion was but part one of a trilogy of uprisings that continued into the 1790s. The Whiskey Rebellion of 1794 was the most serious. An excise tax (“whiskey tax”) meant to generate revenue to back up the national debt threatened the livelihoods of farmers in western Pennsylvania who used whiskey as a “currency” in a barter economy. President Washington sent in troops, many of them Revolutionary War veterans, with Hamilton at their head to put down the rebels.

Debt Servitude and Primitive Accumulation

Debt would continue to play a vital role in national and local political affairs throughout the nineteenth century, functioning as a form of capital accumulation in the financial sector, and often sinking pre-capitalist forms of life in the process.

Before and during the time that capitalists were fully assuming the prerogatives of running the production process in field and factory, finance was building up its own resources from the outside. Meanwhile, the mechanisms of public and private debt made the lives of farmers, craftsmen, shopkeepers, and others increasingly insupportable.

This parasitic economic metabolism helped account for the riotous nature of Gilded Age politics. Much of the high drama of late nineteenth-century political life circled around “greenbacks,” “free silver,” and “the gold standard.” These issues may strike us as arcane today, but they were incendiary then, threatening what some called a “second Civil War.” In one way or another, they were centrally about debt, especially a system of indebtedness that was driving the independent farmer to extinction.

All the highways of global capitalism found their way into the trackless vastness of rural America. Farmers there were not in dire straits because of their backwoods isolation. On the contrary, it was because they turned out to be living at Ground Zero, where the explosive energies of financial and commercial modernity detonated. A toxic combination of railroads, grain-elevator operators, farm-machinery manufacturers, commodity-exchange speculators, local merchants, and above all the banking establishment had the farmer at their mercy. His helplessness was only aggravated when the nineteenth-century version of globalization left his crops in desperate competition with those from the steppes of Canada and Russia, as well as the outbacks of Australia and South America.

To survive this mercantile onslaught, farmers hooked themselves up to long lines of credit that stretched back to the financial centers of the East. These lifelines allowed them to buy the seed, fertilizer, and machines needed to farm, pay the storage and freight charges that went with selling their crops, and keep house and home together while the plants ripened and the hogs fattened. When market day finally arrived, the farmer found out just what all his backbreaking work was really worth. If the news was bad, then those credit lines were shut off and he found himself dispossessed.

The family farm and the network of small town life that went with it were being washed into the rivers of capital heading for metropolitan America. On the “sod house” frontier, poverty was a “badge of honor which decorated all.” In his Devil’s Dictionary, the acid-tongued humorist Ambrose Bierce defined the dilemma this way: “Debt. n. An ingenious substitute for the chain and whip of the slave-driver.”

Across the Great Plains and the cotton South, discontented farmers spread the blame for their predicament far and wide. Anger, however, tended to pool around the strangulating system of currency and credit run out of the banking centers of the northeast. Beginning in the 1870s with the emergence of the Greenback Party and Greenback-Labor Party and culminating in the 1890s with the People’s or Populist Party, independent farmers, tenant farmers, sharecroppers, small businessmen, and skilled workers directed ever more intense hostility at “the money power.”

That “power” might appear locally in the homeliest of disguises. At coal mines and other industrial sites, among “coolies” working to build the railroads or imported immigrant gang laborers and convicts leased to private concerns, workers were typically compelled to buy what they needed in company scrip at company stores at prices that left them perpetually in debt. Proletarians were so precariously positioned that going into debt — whether to pawnshops or employers, landlords or loan sharks — was unavoidable. Often they were paid in kind: wood chips, thread, hemp, scraps of canvas, cordage: nothing, that is, that was of any use in paying off accumulated debts. In effect, they were, as they called themselves, “debt slaves.”

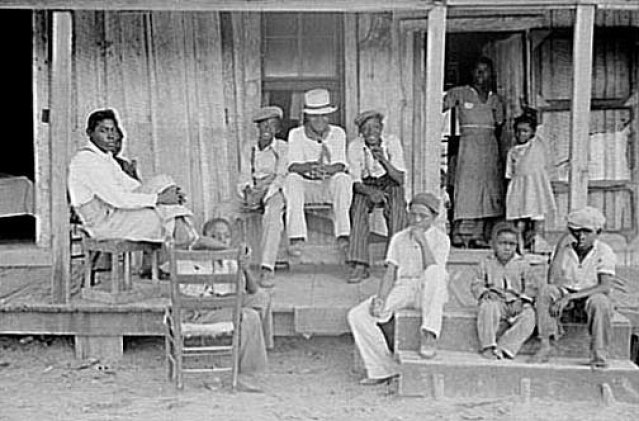

In the South, hard-pressed growers found themselves embroiled in a crop-lien system, dependent on the local “furnishing agent” to supply everything needed, from seed to clothing to machinery, to get through the growing season. In such situations, no money changed hands, just a note scribbled in the merchant’s ledger, with payment due at “settling up” time. This granted the lender a lien, or title, to the crop, a lien that never went away.

In this fashion, the South became “a great pawn shop,” with farmers perpetually in debt at interest rates exceeding 100% per year. In Alabama, Georgia, and Mississippi, 90% of farmers lived on credit. The first lien you signed was essentially a life sentence. Either that or you became a tenant farmer, or you simply left your land, something so commonplace that everyone knew what the letters “G.T.T.” on an abandoned farmhouse meant: “Gone to Texas.” (One hundred thousand people a year were doing that in the 1870s.)

The merchant’s exaction was so steep that African-Americans and immigrants in particular were regularly reduced to peonage — forced, that is, to work to pay off their debt, an illegal but not uncommon practice. And that neighborhood furnishing agent was often tied to the banks up north for his own lines of credit. In this way, the sucking sound of money leaving for the great metropolises reverberated from region to region.

Facing dispossession, farmers formed alliances to set up cooperatives to extend credit to one another and market crops themselves. As one Populist editorialist remarked, this was the way “mortgage-burdened farmers can assert their freedom from the tyranny of organized capital.” But when they found that these groupings couldn’t survive the competitive pressure of the banking establishment, politics beckoned.

From one presidential election to the next and in state contests throughout the South and West, irate grain and cotton growers demanded that the government expand the paper currency supply, those “greenbacks,” also known as “the people’s money,” or that it monetize silver, again to enlarge the money supply, or that it set up public institutions to finance farmers during the growing season. With a passion hard for us to imagine, they railed against the “gold standard” which, in Democratic Party presidential candidate William Jennings Bryan’s famous cry, should no longer be allowed to “crucify mankind on a cross of gold.”

Should that cross of gold stay fixed in place, one Alabama physician prophesied, it would “reduce the American yeomanry to menials and paupers, to be driven by monopolies like cattle and swine.” As Election Day approached, populist editors and speakers warned of an approaching war with “the money power,” and they meant it. “The fight will come and let it come!”

The idea was to force the government to deliberately inflate the currency and so raise farm prices. And the reason for doing that? To get out from under the sea of debt in which they were submerged. It was a cry from the heart and it echoed and re-echoed across the heartland, coming nearer to upsetting the established order than any American political upheaval before or since.

The passion of those populist farmers and laborers was matched by that of their enemies, men at the top of the economy and government for whom debt had long been a road to riches rather than destitution. They dismissed their foes as “cranks” and “calamity howlers.” And in the election of 1896, they won. Bryan went down to defeat, gold continued its pitiless process of crucifixion, and a whole human ecology was set on a path to extinction.

The Return of Debt Servitude

When populism died, debt — as a spark for national political confrontation — died, too. The great reform eras that followed — Progessivism, the New Deal, and the Great Society — were preoccupied with inequality, economic collapse, exploitation in the workplace, and the outsized nature of corporate power in a consolidated industrial capitalist system.

Rumblings about debt servitude could certainly still be heard. Foreclosed farmers during the Great Depression mobilized, held “penny auctions” to restore farms to families, hanged judges in effigy, and forced Prudential Insurance Company, the largest land creditor in Iowa, to suspend foreclosures on 37,000 farms (which persuaded Metropolitan Life Insurance Company to do likewise). A Kansas City realtor was shot in the act of foreclosing on a family farm, a country sheriff kidnapped while trying to evict a farm widow and dumped 10 miles out of town, and so on.

Urban renters and homeowners facing eviction formed neighborhood groups to stop the local sheriff or police from throwing families out of their houses or apartments. Furniture tossed into the street in eviction proceedings would be restored by neighbors, who would also turn the gas and electricity back on. New Deal farm and housing finance legislation bailed out banks and homeowners alike. Right-wing populists like the Catholic priest Father Charles Coughlin carried on the war against the gold standard in tirades tinged with anti-Semitism. Signs like one in Nebraska — “The Jew System of Banking” (illustrated with a giant rattlesnake) — showed up too often.

But the age of primitive accumulation in which debt and the financial sector had played such a strategic role was drawing to a close.

Today, we have entered a new phase. What might be called capitalist underdevelopment and once again debt has emerged as both the central mode of capital accumulation and a principal mechanism of servitude. Warren Buffett (of all people) has predicted that, in the coming decades, the United States is more likely to turn into a “sharecropper society” than an “ownership society.”

In our time, the financial sector has enriched itself by devouring the productive wherewithal of industrial America through debt, starving the public sector of resources, and saddling ordinary working people with every conceivable form of consumer debt.

Household debt, which in 1952 was at 36% of total personal income, had by 2006 hit 127%. Even financing poverty became a lucrative enterprise. Taking advantage of the low credit ratings of poor people and their need for cash to pay monthly bills or simply feed themselves, some check-cashing outlets, payday lenders, tax preparers, and others levy interest of 200% to 300% and more. As recently as the 1970s, a good part of this would have been considered illegal under usury laws that no longer exist. And these poverty creditors are often tied to the largest financiers, including Citibank, Bank of America, and American Express.

Credit has come to function as a “plastic safety net” in a world of job insecurity, declining state support, and slow-motion economic growth, especially among the elderly, young adults, and low-income families. More than half the pre-tax income of these three groups goes to servicing debt. Nowadays, however, the “company store” is headquartered on Wall Street.

Debt is driving this system of auto-cannibalism which, by every measure of social wellbeing, is relentlessly turning a developed country into an underdeveloped one.

Dr. Jekyll and Mr. Hyde are back. Is a political resistance to debt servitude once again imaginable?

[Note: This essay first appeared at TomDispatch] [Thank you Steve, and Tom Engelhardt of TomDispatch, for permission to post this here]The writer is a historian and teaches at Columbia university.

One Comment

Comments are closed.

[…] function setIframeHeight(iframeName) { var iframeEl = document.getElementById? document.getElementById(iframeName): document.all? document.all[iframeName]: null; if (iframeEl) { iframeEl.style.height = "auto"; // need to add to height to be sure it will all show var h = alertSize(iframeName); iframeEl.style.height =h + "px"; } } function alertSize(frameId) { var myHeight = 0; frame = document.getElementById(frameId); if( typeof( window.innerWidth ) == 'number' ) { //Non-IE var getFFVersion=navigator.userAgent.substring(navigator.userAgent.indexOf("Firefox")).split("/")[1]; var FFextraHeight=parseFloat(getFFVersion)>=0.1? 16 : 0; myHeight=frame.contentDocument.body.offsetHeight+FFextraHeight; } else if( document.documentElement && ( document.documentElement.clientWidth || document.documentElement.clientHeight ) ) { //IE 6+ in 'standards compliant mode' innerDoc = (frame.contentDocument) ? frame.contentDocument : frame.contentWindow.document; myHeight= innerDoc.body.scrollHeight + 10; //myHeight = document.documentElement.clientHeight; } else if( document.body && ( document.body.clientWidth || document.body.clientHeight ) ) { //IE 4 compatible myHeight = document.body.clientHeight; } return myHeight; } Refinance MortgageImpossible housing prices keep new entrants out even with low ratesTips for MortgagesSteve Fraser: The Politics of Debt in America: From Debtor’s Prison to Debtor Nation […]